Donald Trump's Economic Policy- READY!! FIRE!! AIM!!

He thinks he's an economic genius thinking outside the box, but he's going to kill the American working class

Our enemies are innovative and resourceful, and so are we. They never stop thinking about new ways to harm our country and our people, and neither do we.

George W. Bush

One of the biggest abuses of intelligence is to believe that if you have enough of it you can reinvent the truth. Stupidity believes the same thing.

Craig D. Lounsbrough

I sometimes wonder if MAGA Nation understands the various ways in which Donald Trump intends to fuck America over. Of course, the fact that I’m asking that question makes it clear they DON’T get it. Their lips are so firmly attached (metaphorically speaking) to Orange Jesus’s ample backside that they’ve lost all perspective.

SURELY, THE LEOPARDS WOULD NEVER EAT MY FACE, the Trumpers have convinced themselves. I’m a White Conservative Christian Cisgender Heterosexual patriot, and Trump will ALWAYS have my back.

Yeah, until the leopards eat your face, you stupid, gullible fuckwit….

Well, PeeWee, you might want to sit down for this, because if Trump is re-elected, he’s preparing to bend the working class over a chair and sodomize y’all with a broom handle. The only question is whether he’ll be kind enough to use a bit of Vaseline on the business end first.

I’m guessing the answer to that question is an uproariously funny “NO!”

Even as US businesses lobby President Joe Biden to reduce or eliminate the tariffs his predecessor imposed on Chinese imports, Donald Trump is doubling down — quintupling down, in fact. Trump is considering a 60% tariff on all Chinese imports if he is reelected, according to reports, which would be five times the current average rate of 12%.

Even that understates the harm a higher tariff would do. Back-of-the-envelope calculations suggest that the new tariff would be 25 times more costly than existing trade restrictions. That would not only wreck the US economy and wreak havoc with global supply chains, but it would also devastate the federal budget.

The Tax Foundation estimates that existing tariffs on Chinese goods cost the economy roughly $60 billion a year. Yet the damage from a tariff goes up with the square of the rate. Doubling a tariff, for example, produces four times the damage. So quintupling the US tariff on China, as Trump proposes to do, would cost the US economy approximately $1.5 trillion a year.

A tariff of that size would also create a global supply chain shock as producers scurried to find alternative sources for Chinese imports.

Why would Donald Trump do this? Perhaps because he’s operating from a place of wishful/delusional thinking. He seems convinced that by hitting China with increased tariffs, he’ll “finally” make China “pay their fair share.”

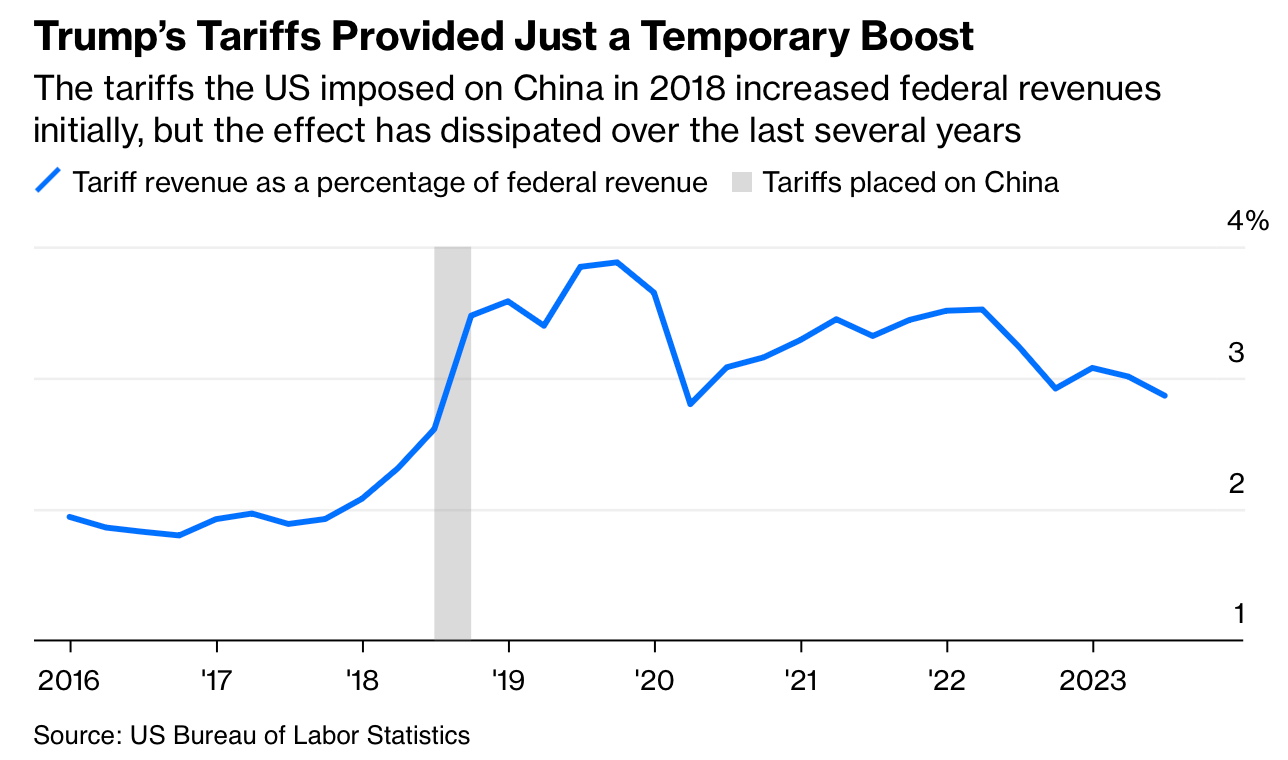

Except we have his first term to fall back on for an idea of what could happen, and past results might well indicate future performance, even though Trump’s tariffs didn’t do much for federal revenues over the long haul.

As for their impact on our domestic economy, the tariffs imposed on China during Trump’s first term in office, while meant to punish China, punished everyday Americans far more.

“I took on Communist China like no administration in history, bringing in hundreds of billions of dollars pouring right into our Treasury when no other president had gotten even literally 10 cents out of China,” Trump said in New Hampshire before he won that state’s primary contest. “Nobody even tried. We took in hundreds of billions of dollars.”

Most economists say these costs were primarily paid by U.S. consumers and firms, not by China’s government or the Communist Party….

“The 2018-to-2019 trade war was immensely damaging, and this would go so far beyond that it’s hard to even compare to that,” said Erica York, senior economist at the Tax Foundation, a right-leaning think tank that opposes the tariffs. “This threatens to upend and fragment global trade to an extent we haven’t seen in centuries.”….

Trump repeatedly boasts of bringing in billions of dollars to U.S. coffers through the tariffs he imposed while he was president, though he added roughly $8 trillion to the national debt during his term through higher spending and tax cuts. Trump also approved roughly $30 billion in a bailout to compensate farmers who had been hurt by retaliatory tariffs imposed by China.

Few benefits accrued to the American people from Trump’s trade war with China. Aside from whatever political benefits he may have obtained from “looking tough” in his dealings with what was the world’s fastest-growing economic power at the time, he had to bail out farmers to avoid a major political crisis.

Though unanimity among economists is challenging to nail down on any topic, the failure of Donald Trump’s trade wars is generally a widely held belief. Indeed, there was no logical reason to upset an apple cart that would’ve been just fine left alone.

In true bull-in-a-china-shop fashion, though, Trump felt the need to make a statement, to impress upon America and the world that the economy was his bailiwick; this was where he would work his magic and make things even better.

He took a global economy in good but not great shape and set it on the road to being FUBAR’d.

Trump’s first trade war was a failure. Though intended to boost U.S. manufacturing and reduce the trade imbalance, (unsurprisingly) neither occurred. Americans almost exclusively paid the tariffs that the U.S. imposed on nearly $380 billion worth of imports. Businesses faced higher costs, making it harder to compete internationally. Foreign governments retaliated with tariffs on U.S. exports, and China halted its purchases of agricultural products altogether. Lobbying, along with political favoritism, mushroomed.

One Federal Reserve paper concluded, “the impact from the traditional import protection channel is completely offset in the short-run by reduced competitiveness from retaliation and higher costs in downstream industries.” In other words, the tariffs didn’t create a net benefit because protection for some was outweighed by costs for others.

Escalating a failed trade war defies any semblance of sound policy and is motivated by faulty understanding. As Scott Lincicome explains, China does not pose a significant economic threat to the United States. To be sure, China has and continues to display bad behavior: from increasing authoritarianism, market interventions, and its own industrial policy to human rights abuses and intellectual property theft. But a prohibitive tariff does nothing to directly address China’s problematic behaviors. Instead, it risks upending a global economic system that has delivered massive gains (and yes, concentrated pains) to the U.S. economy.

OK, the paragraphs above are from the Tax Foundation, which means the tax policy analysis is about as exciting as most quarterly P&L statements. The short version is that a trade war based on significantly raising tariffs is a terrible, awful, very bad idea.

“In other words, the tariffs didn’t create a net benefit because protection for some was outweighed by costs for others.” In other words, nobody wins. Duh.

I was an economics major for a hot minute in college; even I could’ve figured that out.

Now along comes Donny Diaperfull- again- and he wants to prove to us that he’s learned precisely NOTHING from the YUUUUGE mistakes he made the first time around. In fact, he wants to make even YUUUUGER fuckups in this go-round.

This is why Orange Jesus should be on the maximum allowable therapeutic dose of Thorazine…and not allowed anywhere near the Resolute desk in the Oval Office. The man’s a menace to anyone who knows what they’re doing.

Not that Jabba the Trump is a student of history, but he should be because he’d understand that trade wars don’t work. They don’t work today, and they’ve never worked. No. One. Wins.

In 1807, caught in the middle of a conflict between France and Great Britain, President Thomas Jefferson imposed an outright embargo on all trade. The embargo was intended to be a “commercial weapon” according to Jefferson, the idea being to use economic forces to coerce both nations to treat the U.S. neutrally. As trade came to a grinding halt under the embargo, prices of would-be exports plummeted, and prices of would-be imports spiked. Estimates suggest the economy shrank by 5 percent as a result of the embargo. It was not long before political support for the policy began to fall and merchants began to violate the embargo. Congress ultimately repealed the embargo after 15 months.

Ultimately, the people most hurt by a trade war are those doing the trading. Politicians never have to worry about where their next Big Mac is coming from, but those producing and exporting goods can’t buy those Big Macs if they can’t produce and ship them.

Our economy should never be weaponized…because the people we think will be hurt seldom suffer the consequences.

Just a couple of decades later, Congress enacted the Tariff Act of 1828, largely a result of political brinkmanship and trickery. The law imposed significant tariff hikes on raw materials, and that lopsided nature of levying significant tax increases on manufacturing inputs led one Congressman to call it a “bill of abominations.” The nickname stuck, and under the Tariff of Abominations, the average tariff rate on imports climbed to “reach 62 percent in 1830, the highest level in U.S. history,” according to economist Douglas Irwin. As Irwin recounts in a lesson for policymakers today:

[Vice President John] Calhoun later described the 1828 tariff as “a combined measure, originating with the politicians and manufacturers, and intended as much to bear upon the presidential election as to protect manufacturers.” In retrospect, Calhoun said that he “was amazed at the folly and infatuation of that period. So completely absorbed was Congress in the game of ambition and avarice, from the double impulse of the manufacturers and politicians, that none but a few appeared to anticipate the present crisis, at which all are now alarmed, but which is the inevitable result of what was then done.”

Regarding domestic impact, a 60% tariff on imported goods from China could be an economic disaster. While Donny Diaperfull believes the Chinese government will pay those costs, Americans will almost certainly pay most of them, and the impact would be considerable.

A 60% tariff on imports from China will raise about $200 billion in taxes, which American consumers will primarily pay through higher prices.

[A] 60 percent tariff is not designed to raise tax revenue, it is designed to prohibit trade. Thus the potential tax costs illustrate just the tip of the iceberg of the total economic costs of a prohibitive tariff.

Imports from China would depress significantly. Supply chains would fragment, investment plans would be disrupted, and trade would be diverted to third countries. A prohibitive tariff would create a void in trading opportunities with China that other countries would fill, leaving the U.S. excluded.

In sum, it is not a thoughtful approach to the U.S.-China economic relationship. The economic costs of prohibiting trade with China would undercut the benefits of the tax reforms put into place under the Trump administration, harming business investment and innovation and placing U.S. businesses at a competitive disadvantage.

Trump has also endorsed removing China’s “most favored nation” status and floated the idea of imposing a 10% tariff on ALL imports, which totaled $3 trillion in 2022, the last year for which figures are available.

Why would Trump gamble with an economy that’s running smoothly? Unemployment has dropped to 3.7%, inflation has dropped considerably from just after the pandemic, and about 200,000 jobs are being created monthly. Why take a chance on breaking what doesn’t need to be fixed?

The last time Trump imposed tariffs on our allies- for national security reasons that existed only in his imagination- countries like Japan and South Korea refrained from retaliating. They believed the American President would soon come to his senses, something that didn’t happen. If there were to be a repeat, it’s unlikely our allies would grant Trump the same forbearance they previously did.

And then there’s his idea for a universal baseline tariff, which would be a new, across-the-board tax on all imported goods. While the details are scarce, Trump has floated the idea of a 10% tax. To date, this idea has generated far more questions than answers.

Mr. Trump said whether the new tariff would apply to imports from the nearly two dozen countries with which the United States has free trade deals. They include Canada and Mexico, which together account for nearly a fifth of the overall U.S. trade deficit in goods, and with which Mr. Trump’s administration renegotiated the nearly tariff-free trade deal that replaced NAFTA.

The Trump campaign noted that Mr. Trump has not announced any decision on that question. But Canada’s ambassador to the United States, Kirsten Hillman, said in an interview that her country believes its exports should be exempted from any new universal tariffs.

“We just concluded this deal with 99 percent of tariffs at zero under the previous Trump administration, so it’s our expectation these proposed policies would not apply to Canada,” she said.

Mr. Trump has also not said whether he thinks he could unilaterally impose the sweeping new tariff under existing law or would need Congress to authorize it.

I’m not an economist, but I look at what Donald Trump is proposing with abject terror. It’s not that his ideas couldn’t or won’t work; it’s more the idea of coming into managing an economy that’s working well and deciding to blow it up so you can do it your way.

Why? Why impose solutions when there aren’t problems afoot?

This isn’t an abstract concept. We’re talking about hundreds of thousands of people’s lives and livelihoods. What Trump proposes will have an economic impact not only in the macro-sense but also hit Joe and Ethel Sixpack hard.

Why would a new President come into an economy that, by all indicators, is running far better than anyone thought it would be and drop a grenade into it?

President Joe Biden and his team have done an excellent job of managing the economy. How many so-called “experts” confidently predicted that America would be in a recession now? Yet unemployment is down, job numbers are up, and inflation appears to be under control. Even better, consumer confidence is on the way up. Who would’ve thought any of this would be true nine months before the Presidential election?

[A] swirl of dislocating losses and gains would ripple out from such a policy of universal tariffs. On the one hand, some domestic manufacturing would rise since domestic makers of rival goods could raise their prices and expand production. That is Mr. Trump’s focus: “We will quickly become a manufacturing powerhouse like the world has never seen before,” he promised in a campaign video.

As a matter of textbook economics, there would also be downsides. It would amount to a tax increase passed onto consumers in the form of higher prices — one that would fall more heavily on poorer people since they spend a higher portion of their incomes on goods.

The policy could also lead to downward pressure on other domestic manufacturing. Producers who buy inputs from abroad would pay higher costs, making their products less competitive in the global market. Retaliatory tariffs would reduce demand for U.S. exports.

Sometimes, leaving well enough alone is the best plan, but Donald Trump has never met a success that he couldn’t thoroughly fuck up through effort and application.

Nikki Haley was right about one thing: Chaos follows Donny Diaperfull wherever he goes. As President again, he’d lead the country through one epic clusterfuck after another. Is that really what Americans want?

One of my favorite writer’s jokes is one I heard a few years ago from Dave Barry. A writer has been stranded in the desert without water for days when suddenly he sees an oasis. He used his last reserves of energy to reach the oasis and, upon arrival, collapsed at the water’s edge and began to drink deeply and slake his titanic thirst.

The writer is blissfully happy; the water is the sweetest thing he’s ever tasted. His rapturous joy is suddenly broken when he hears what sounds like something being poured into the water. He looks up to see his editor with his dick in his hand as he pees into the water.

“WHAT ARE YOU DOING???” screams the writer, incensed at the intrusion.

With a beatific smile, the editor intones, “I’m making it better!!”

This story describes Orange Jesus in a nutshell.

Donald Trump may think he’s the editor, but he won’t be improving the economy. Truthfully, the only thing he’s going to be able to do is fuck it up. Not that he hasn’t done it before, but for some reason, MAGA Nation is convinced he’s just the economic genius America needs.

That’s precisely the problem we face.

(All of my posts are now public. Any reader financial support will be considered pledges- support that’s greatly appreciated but not required to get to all of my work. I’ll trust my readers to determine if my work is worthy of their financial support and at what level. To those who do offer their support, thank you. It means more than you know.)

Something that has been obvious since at least Hoover: business people (real or merely so-called) don't know jack shit about economics.