[On] Black Friday, Americans officially kick off what analysts expect to be a record-breaking holiday sales season. But as inflation and supply chain woes potentially suppress lower-income households’ spending as the price of food and other essentials ticks upwards, wealthy Americans are expected to more than make up the difference.

It’s not humbug to point out that this disparity in disposable income is no accident — if anything, it’s a choice that lawmakers have made again and again over the decades.

Policymakers and economists in America once agreed that a progressive tax system yields the best results. All that means is that the government imposes a higher percentage rate on taxpayers who have higher incomes. In other words: If you make more, you pay more, proportionately, in taxes. This isn’t a terribly controversial idea.

It’s an interesting hypothetical question that’s rapidly becoming less theoretical: How much is enough? How much money does a person need to be able to live in absolute financial security? And does being a billionaire mean that one has too much money and that they have a more significant debt to society?

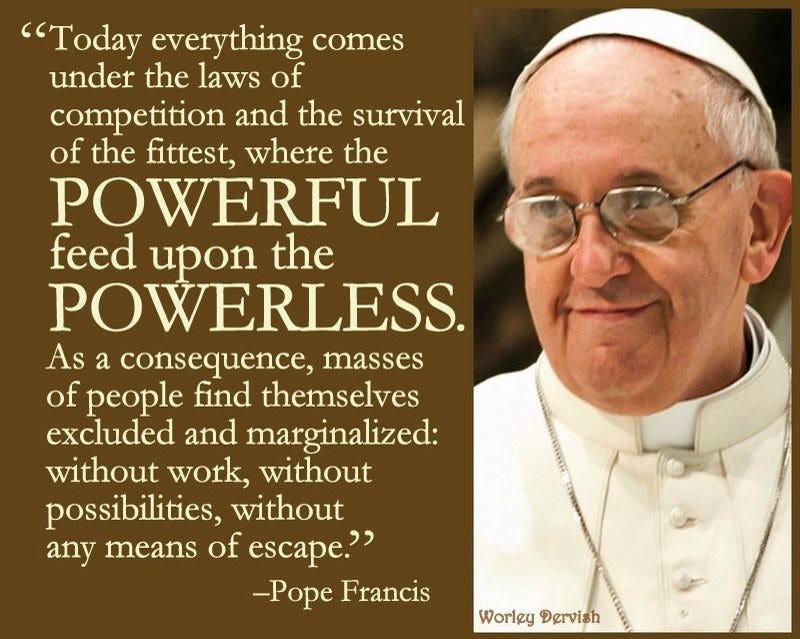

That’s three questions, but you get my point, right? America is a country increasingly beset by astonishing- and growing- income disparity. People like Jeff Bezos, Bill Gates, and Elon Musk are unimaginably wealthy even as others sleep under bridges, struggle to pay rent, and pray that they’ll be able to feed their families.

How is that fair, rational, or even sensible?

No one wants to disincentivize Americans who’ve achieved astonishing financial success, but at what point are the rest of us within our rights to expect them to pay their taxes, to pay their fair share? And isn’t this the point of a progressive tax system?

Nor is the idea that it’s actually economically beneficial to leave poor and low-wealth people with a greater proportion of the money they earn. Generally speaking, those earners will spend most, if not all of it, locally: at grocery stores, retail shops, small businesses, for car repairs and doctor’s visits. This in turn has a multiplier effect on each dollar.

That’s the taxation system the United States is supposed to be following. But you wouldn’t know it given the lengths some of our lawmakers go to protect the investment accounts of America’s ultra-rich.

And it’s particularly relevant right now because of President Joe Biden’s social spending plan. If the House-passed version of the Build Back Better Act becomes law, it will cost $1.75 trillion dollars to overhaul America’s health care, childcare, education, and climate systems. A major question still facing the Senate is whether the bill will ultimately be “paid for” by tax increases on the wealthy?

The “billionaire tax” is, unsurprisingly, rather popular among Americans. The idea of taxing someone else is a guilt-free idea we can all feel good about, right? There’s more to it than that, though. The “billionaire tax” would target approximately 700 Americans in a nation where more than 37 MILLION live in poverty. The 700 in question live in unimaginable wealth beyond anything most mere mortals could imagine.

So, again I ask the question- how much is enough? And will the “billionaire tax” have a deleterious impact on the financial future of 700 American billionaires?

How many yachts? How many homes? How many private jets? How many high-end luxury automobiles does a person need? At what point is a society within its rights to say it’s time for a person to recognize that they owe a significant debt to the country that makes such unimaginable material wealth possible?

I can hear the nattering nabobs of negativity on the Far-Right screaming “SOCIALISM!!!” as I tap away at my keyboard, but I think it’s a legitimate question. And, at least in this sense, a wee bit o’ socialism isn’t a bad thing.

As our tax code is currently defined, there are so many loopholes and exemptions available to the super-wealthy that many are effectively able to avoid paying taxes altogether. That this is unjust barely needs to be argued, but some object to “job creators” being taxed at all. And Congress exists to do the bidding of those who donate large sums of cash to campaign war chests.

Who says American democracy isn’t the best form of government money can buy?

One last-minute proposal to pay for part of it is a new billionaire income tax, first proposed by Sen. Ron Wyden, D-Ore. The ultra-rich generate a lot of their wealth from assets, like stocks. But, as the tax code stands right now, the ultra-wealthy don’t pay taxes on those investments until they are sold. They’re instead allowed to accumulate what are called “unrealized gains”: they are wealthier on paper but, unless they sell the stock, the government doesn’t consider the wealth increase to be income.

Except for the ultra-wealthy, those unrealized gains function a lot like income, often acting as collateral against low or even zero interest loans, often from their own companies.

Tesla CEO Elon Musk is a prime example: he takes neither a salary nor a cash bonus from Tesla; he’d have to pay income tax on those. Instead, he gets stock options. As of the first week of November, his stock value was worth about $28 billion. And, in lieu of all the cash tied up in those stocks, he’s taken out loans from Tesla, using the stock as collateral to use for his expenses. (Try that at your local bank and see how it works out for you.)

The billionaire tax isn’t some socialist hunt ahead of eating the rich. It would only apply to those with more than $1 billion in assets for three consecutive years, or anyone with more than $100 million dollars in annual income. To put a finer point on it, median household wealth in America is about $700,000, according to CNBC. This would result in increased tax on people with wealth that is 1,420 times as much as that.

Most Americans who collect a paycheck get a W-2 form every year, a copy of which goes to the Internal Revenue Service (IRS). That means the federal government knows EXACTLY how much the vast majority of Americans earn during a calendar year. The fortunate few who generate their income from stocks and other assets don’t get a W-2 detailing how much they’ve made during a year. This means the federal government has NO idea how much someone like Jeff Bezos or Elon Musk earns; it must rely on them to tell the government how much they made. So they employ armies of accountants and tax attorneys to ferret out loopholes that will reduce their tax burden.

That these advantages aren’t available to Joe and Ethel Sixpack is a shining example of the unfair bifurcation of our tax system, which has evolved into something intended solely for the benefit of the ultrawealthy.

The tax code is not only unfair, but it also maintains the disparity between the haves and the have-nots. And Congress has no incentive whatsoever to change that- because guess who writes them the biggest checks?

If Congress doesn’t reform our tax code into something more fair and equitable, which requires the ultrawealthy to pay their fair share, the disparity and discontent will continue to grow. Revolutions have started for less, and while I’m not saying that Americans will revolt and post the head of Jeff Bezos and Elon Musk on pikes, neither am I saying that it’s outside the realm of possibility.

In the meantime, the “billionaire tax” will provide an opportunity for the IRS to help level the playing field, even if only to a small degree. There’s certainly nothing wrong with asking all Americans to pay their fair share- including the 700 billionaires who currently exploit the tax code to their advantage.

How else are we to pay to restore and repair our crumbling infrastructure- which billionaires also use and derive benefit from?

It’s we insisted that everyone pay their fair share- including the ultrawealthy. After all, it’s not like we’re talking about taking food off their table or their private jet out of its hangar.

Thank you for taking the time to read this. If you enjoyed it, I hope you’ll take a few seconds and join the party via a paid subscription. While you’re at it, why not forward this to a few like-minded friends who might also enjoy it!! You can also donate via Venmo (@Jack-Cluth).