The monthly Jobs Report- The sky is falling...or not...depending on what you need the numbers to say

Silly wabbit...and you thought Economics was supposed to be a science

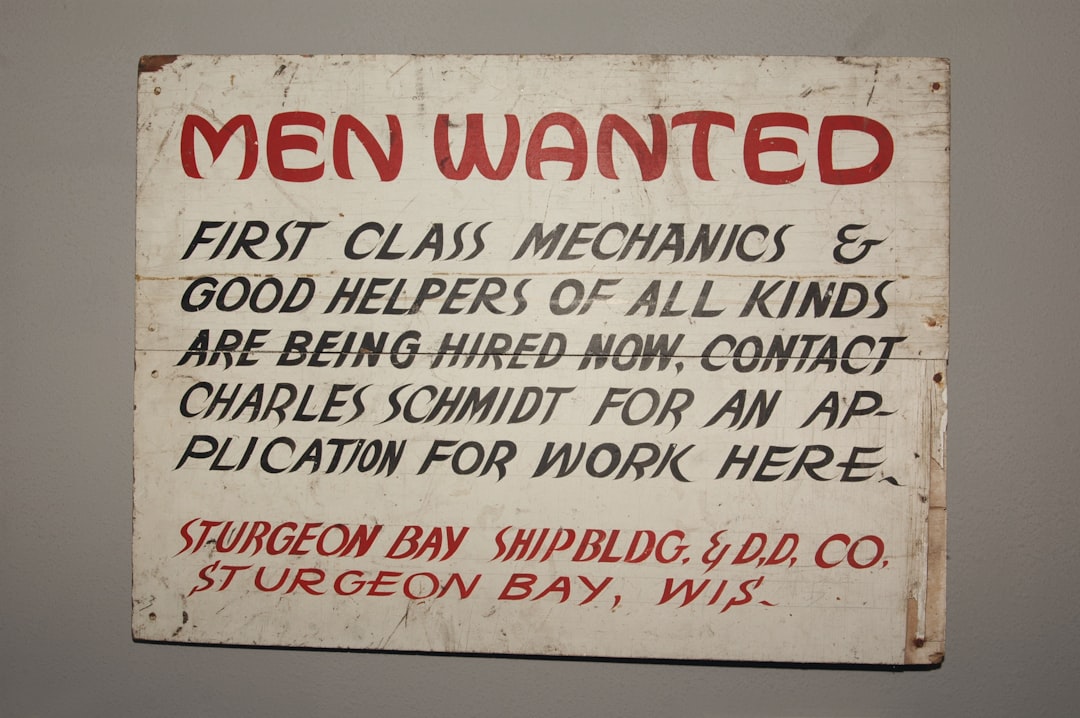

Slowdown? What slowdown? The U.S. labor market continues to exhibit amazing strength, with the number of new jobs created last month nearly twice as large as expected.

George Mateyo, Chief Investment Officer at Key Private Bank

OK, so let me see if I have this straight. Unemployment is down. Job numbers are up. But things are bad if things look TOO good and the Federal Reserve gets uptight. But that might be good in the long run.

Is anyone else confused??

The worst part is that no matter how good (or bad?) the numbers look, the American Sheeple still think the economy is for shit.

I may be a simple History and Anthropology major, and Economics was never my forte, but this all still seems pretty messed up.

Some numbers are good when they’re up; some are bad when they’re down. Others are good when they’re down and bad when they’re up, and I feel like I’m not making sense because when it comes to money-related numbers, my brain turns to oatmeal. And even if that weren’t the case, most of this still wouldn’t make sense to me.

My brain ‘urts. (Sorry for the gratuitous Monty Python reference.)

The monthly jobs report from the Labor Department’s Bureau of Labor Statistics showed unexpectedly strong job growth, with 336,000 nonfarm jobs added to the economy in September. The unemployment rate remained stubbornly good at 3.8 percent, the same as last month, and pretty much all the other employment stats — broken down by race and sex and long-term unemployment and favorite baseball team — remained pretty much unchanged, although workers who root for the Seattle Mariners experienced a massive wave of familiar but unpleasant “Well shit, there they go again” feels in the final weekend of the month.

The job growth far outpaced the Dow Jones forecast of 170,000 new jobs, and was an increase of 100,000 jobs over August’s numbers, which I missed by going on vacation Labor Day weekend. September’s jobs report was the largest gain in employment since January of this year.

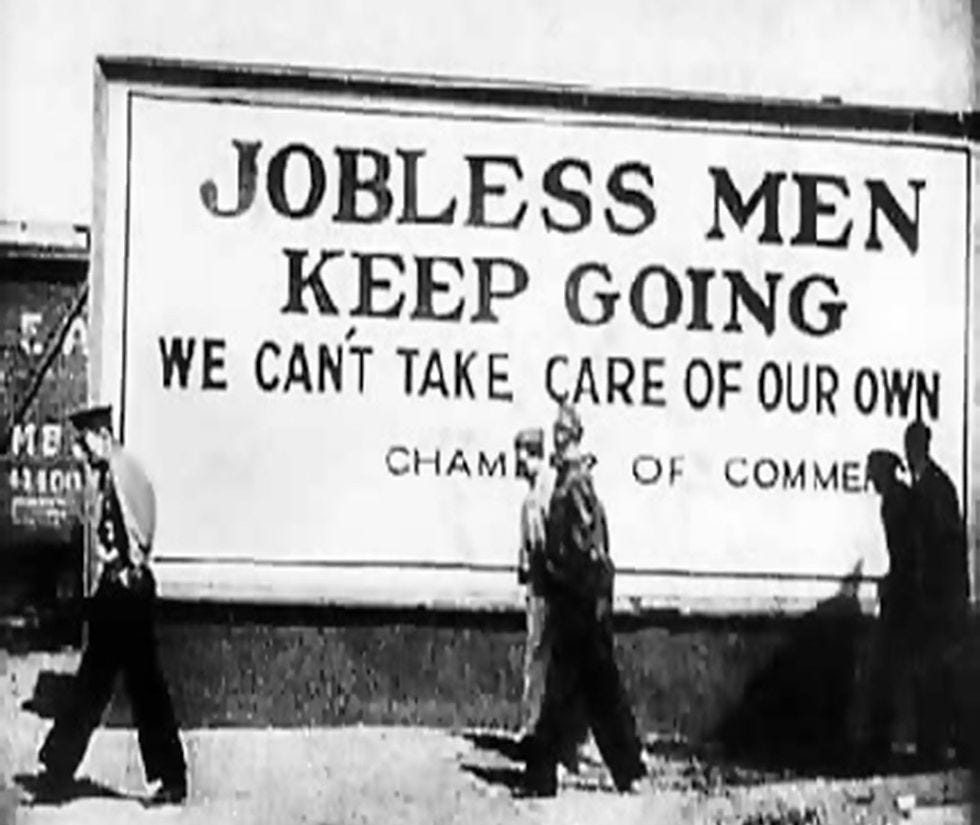

OK, so remind me again how Joe Biden is mishandling the economy…because that’s what so many of the American Sheeple seem to think. Showers of gold (or golden showers) could rain down from the sky, and Americans would somehow fail to make the connection to policies promulgated by the Biden Administration. Are the American Sheeple really that stupid?

On second thought, perhaps y’all shouldn’t make me answer that….

So, to sum things up, peace and prosperity reigned throughout the Kingdom, right?

It certainly seemed that way. But, hey…economists, amiright?? They could be standing outside on a beautiful, sunny, 75-degree day, and if someone were to piss on their head from a second-story window, they’d tell us it was raining.

Investors have been on edge lately that a resilient economy could force the Federal Reserve to keep interest rates high and perhaps even hike more as inflation remains elevated.

Wage increases, however, were softer than expected, with average hourly earnings up 0.2% for the month and 4.2% from a year ago, compared to respective estimates for 0.3% and 4.3%.

It all probably means the Fed is likely to ratchet up interest rates again, after taking a break for a bit, unless of course it doesn’t. Either way, the drama will be as incredible and unprecedented as it always is.

If you’re trying to buy a house, you’re hosed because interest rates are in the 7% range. Meanwhile, the mortgage on our little slice of Heaven is pegged at 2.73% because we bought it in early 2015 when banks were practically giving mortgages away.

There’s a downside to that, of course. We can’t sell (even if we were so inclined, which we’re not) because we’d never find an interest rate close to what we’re paying now. If we were to buy the same house we’re in at today’s rates, we’d be paying hundreds of thousands more over the life of the loan. Never mind that our monthly payments would be significantly higher than we pay now.

So, no, we’re not moving any time soon, which is OK because we love our home and have no plans to leave (though running away to Canada remains a possible option).

So when is good news bad news that might be camouflaged as good news? When economists decided to paint things that way, I suppose.

Did you get all of that? Don’tcha just LOVE the “economic news is always complex…[and] this complexity…makes it even more perplexing that a good Jobs Report must be reported as unilaterally bad news” aspect?

“We just had a phenomenal amount of jobs added to the economy last month, and the unemployment rate is at a historic low, which is actually terrible news. This will drive interest rates and gas prices up, and before long, most Americans will be unable to afford anything bigger than an electric scooter.”

“This will cause the labor and export markets to crash, causing the cost of food to spike. Most Americans will find it increasingly difficult to afford basic staples. Families will begin to suffer higher degrees of food insecurity, and some will experience the early stages of starvation.”

“As these problems grow, crime and unrest in the streets of America’s cities will develop into racial conflicts and, eventually, full-on race wars. Increasing numbers of citizens will die in riots and firefights as chaos quickly leads to guerilla warfare.”

“As resources become increasingly scarce, survivors of America’s street wars will resort to cannibalism as the living find themselves with no option but to consume the dead littering the streets.”

So, tell me again that it’s just a monthly Jobs Report and not the prequel to a “Mad Max” movie….

Yes, America, our economy added 336,000 jobs last month…but we completely f****d. Yes, that’s right; we’re all one lousy inflation report from living under a bridge and feasting off the flesh of our elders, don’tchaknow??

Can I have Grandma medium rare?

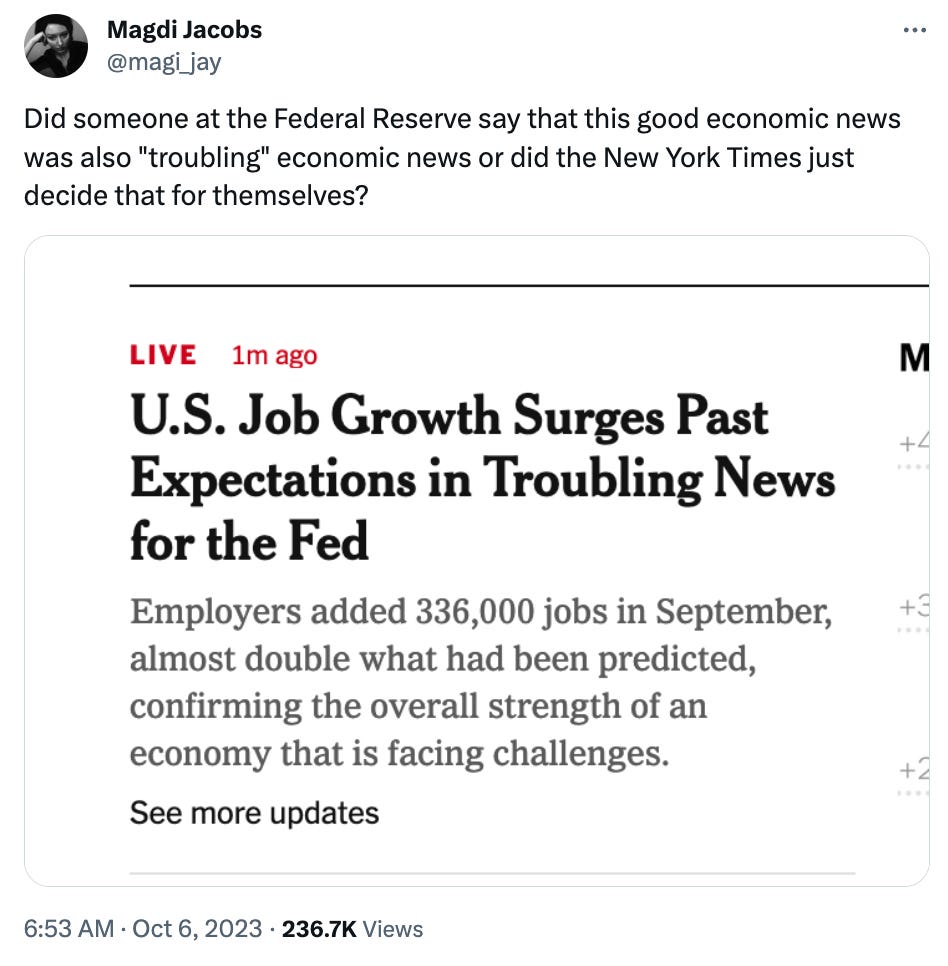

Oh no, a strong jobs report and strong economy! Elsewhere in the thread, Jacobs offers a screenshot of the Times front page that would be hilarious in a movie about a bunch of hacks deliberately slanting the news, leading with the “troubling news” and a group of other dire portents of strong jobs growth:

The jobs report may worry the Federal Reserve.

Interest rates are jumping on Wall Street. What will they do to housing and the economy?

The markets are jittery. Here’s why the strong jobs report may not help.

That last one has been updated to the far more defensible and neutral “Yields Jump and Stocks Swing After Strong Jobs Report,” and the original bullshit main headline, “U.S. Job Growth Surges Past Expectations in Troubling News for the Fed,” has similarly been revised to “U.S. Job Growth Surges Past Expectations in a Sign of Unexpected Vigor.”

I took macroeconomics and microeconomics courses during my freshman year in college. What I remember taking away from those exercises in foolishness was the “Wait, so good news may be bad news…and bad news could turn out to be good news?” sense of disbelief.

Then there’s the old joke about having 20 economists in a room and ending up with 20 widely divergent takes on the same economic data. I think it’s true, but I’d rather juggle straight razors in a bathtub than find myself in a room with 20 economists.

I’m still trying to wrap my head around the “a good Jobs Report must be reported as unilaterally bad news” concept. Even to this History major with an ADD diagnosis, that makes no sense.

Then again, all of this data may emerge from a random number generator buried deep in western North Carolina's mountains.

Somewhere in a dense pine forest just outside Asheville lies the key to America’s economic future….

(All of my posts are now public. Any reader financial support will be considered pledges- support that’s greatly appreciated but not required to get to all of my work. I’ll trust my readers to determine if my work is worthy of their financial support and at what level. To those who do offer their support, thank you. It means more than you know.)

When it comes to Monty Python, never say you're sorry.

By the bye, for anyone interested, my goto source for economic analysis is the Center for Economic and Policy Research (CEPR) at http://www.cepr.net/

One of their "main guys," Dean Baker, is a data-driven economist (so he's a liberal) and often has choice words for NYT's economic "analysis." Evidently, if a Democrat is in office, then the news is bad; if a Republican is in office, then the news is good, even surprisingly good. Baker has a number of intro ECON books out, some of which are free for the download, and any and all I'd recommend: https://deanbaker.net/books/books.htm